The Asia Pacific cloud computing market was valued at an astounding USD 94.55 billion in 2022 and is set to soar at a compound annual growth rate (CAGR) of 16.6% from 2023 to 2030. This incredible surge is being driven by factors like the inherent adaptability and robust data security of cloud computing, along with a growing regional demand for hybrid cloud solutions, flexible pay-as-you-go business models, and seamless omni-cloud systems. Furthermore, a rapid shift to digital-centric operations across various organizations, adapting to new ways of working, doing business, and selling goods, is significantly fueling this expansion.

Southeast Asia, in particular, is witnessing an accelerating pace of cloud adoption across diverse sectors including IT & Telecom, manufacturing, and BFSI. This intense activity has led major cloud providers like Amazon Web Services, Google Cloud, and Microsoft Azure to pour investments into the APAC region. For a prime example, in March 2023, Amazon Web Services (AWS) committed USD 6 billion to develop cloud data centers in Malaysia, part of its staggering USD 22.5 billion total investment across Southeast Asian countries like Indonesia, Singapore, and Thailand. Not to be outdone, powerhouses such as Alibaba Group Holding Limited, Microsoft Corporation, IBM Corporation, Tencent, Google LLC, and Oracle Corporation have collectively injected USD 6 billion into Malaysia for data center development. Adding to this, Microsoft Corporation announced a substantial USD 1 billion investment over five years in Malaysia back in 2021. These investments are truly shaping the digital landscape of the region!

Get a preview of the latest developments in the Asia Pacific Cloud Computing Market; Download your FREE sample PDF copy today and explore key data and trends

Meanwhile, the Government of Singapore is setting a global benchmark by rolling out advanced digital platforms to enhance financial planning efficiency and safeguard personal financial information. A shining example is the Singapore Financial Data Exchange (SGFinDex), launched in December 2020 by the Smart Nation and Digital Government Group (SNDGG) and the Monetary Authority of Singapore (MAS). This groundbreaking platform, leveraging a national digital identity and a centrally managed online consent system, is the world's first public digital infrastructure giving citizens access to their financial information held across various government departments and financial institutions. Leading banks, government agencies, and the Singapore Exchange Group (SGX Group) were among the original pioneers in SGFinDex.

Businesses are increasingly outsourcing their functions to cloud providers, seeking greater efficiency, lower costs, enhanced scalability, and improved performance. However, this convenience isn't without its caveats. Outsourcing to cloud providers does introduce certain risks, notably concerning security and confidentiality. Cloud environments, designed for multi-user access, inherently present more access points, making them potentially more susceptible to attacks. As more users and devices connect to the cloud infrastructure, the risk of malicious actors gaining unauthorized access unfortunately increases.

Detailed Segmentation

Service Insights

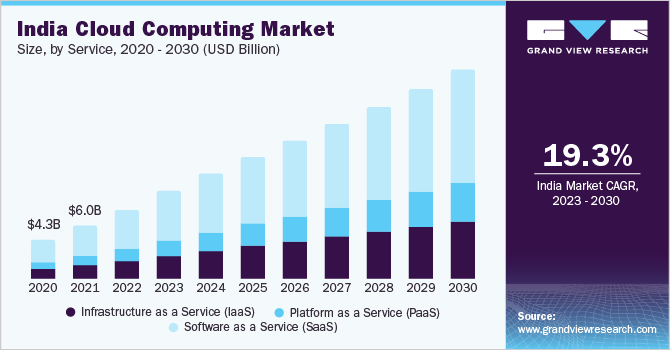

The Software as a Service (SaaS) segment accounted for the largest market share of over 55% in 2022. SaaS eliminates the need for companies to set up and manage software on their own computers or data centers. Therefore, software license, installation, and support, as well as purchase, provisioning, and maintenance of hardware are no longer required. As business requirements evolve continuously, SaaS strives to maintain cost and functionality. Moreover, the emergence of strong local players, the proliferation of various SaaS applications, and the increase in SaaS customers across various industries are also fueling the segment’s growth. In addition, Asia Pacific countries are still developing. The primary concern is always cost-effectiveness. Vendors of SaaS solutions offer solutions with lower operational costs, driving the market growth of the segment.

Deployment Insights

The private cloud deployment segment accounted for the highest market share of over 42% in 2022. Bring Your Own IP is one of the current trends found in the APAC region. For instance, in May 2023, Amazon Web Services made available Virtual Private Cloud, which supports Bring Your Own IP (Internet Protocol) in the India Region. BYOIP allows users to advertise IPv4 and IPv6 addresses on the internet using their own IPv4 and IPv6 addresses. Additionally, through AWS Direct Connect, users can access their on-premises networks via BYOIPv6. BYOIP is also available in various APAC regions such as Hong Kong, Sydney, Tokyo, and Singapore.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 50% in 2022. Cloud computing services are in high demand due to remote working adopted by businesses in the Asia Pacific. Moreover, the need for cloud computing services will grow as market players expand their business by offering new products in the Asia Pacific region, thereby it is anticipated to drive the segment's growth. For instance, in October 2021, Alibaba DAMO Academy, Alibaba Group's global research project, revealed a cloud-based AI-powered now casting platform that anticipated short-term weather patterns.

End-use Insights

The BFSI segment accounted for the highest market share of over 20% in 2022.Increasing online banking activity has led money lenders to embrace the digital revolution, and cloud computing has played an important role in this development. Life insurance companies are adopting digital transformation to streamline their processes, automate operations, and offer digital services to their customers.

Key Asia Pacific Cloud Computing Companies:

- Alibaba Group Holding Limited

- Microsoft Corporation

- Amazon.com Inc.

- Google LLC (Alphabet Inc.)

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Oracle Corporation

- Salesforce.com Inc.

- SAP SE

- Workday, Inc.

Asia Pacific Cloud Computing Market Segmentation

Grand View Research has segmented the Asia Pacific cloud computing market based on service, deployment, enterprise size, end-use, and region:

Asia Pacific Cloud Computing Service Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure as a service (IaaS)

- Platform as a service (PaaS)

- Software as a service (SaaS)

Asia Pacific Cloud Computing Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Public

- Private

- Hybrid

Asia Pacific Cloud Computing Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

Asia Pacific Cloud Computing End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Media & Entertainment

- Government & Public Sector

- Others

Asia Pacific Cloud Computing Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- China

- Japan

- India

- Australia

- South Korea

Curious about the Asia Pacific Cloud Computing Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends