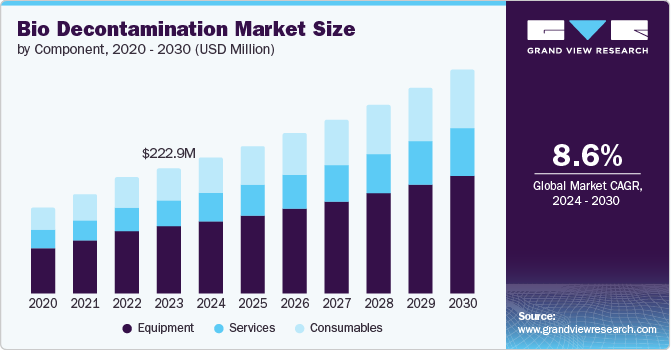

The global bio decontamination market, estimated at $222.96 million in 2023, is anticipated to expand at a compound annual growth rate (CAGR) of 8.62% from 2024 to 2030. This market's growth trajectory is fueled by a confluence of factors, including the increasing volume of surgical interventions, the expansion of the healthcare and pharmaceutical/biotechnology sectors, and the escalating incidence of Hospital-Acquired Infections (HAIs). According to the World Health Organization (WHO), in high-income nations, approximately 7 out of every 100 patients in acute-care hospitals contract at least one HAI; alarmingly, this figure rises to 15 out of 100 in low- and middle-income countries. On average, 1 in 10 patients affected by an HAI succumbs to the infection during their hospital stay. This concerning trend has amplified the critical need for rigorous bio decontamination protocols within healthcare settings.

The rising prevalence of cancer and other chronic illnesses, the rapidly growing elderly population, and advancements in medical technology have collectively contributed to an increase in the number of surgical procedures performed globally. This upswing has consequently heightened the demand for effective bio decontamination services to ensure the sterility and safety of medical equipment and facilities. The surge in surgical interventions necessitates stringent bio decontamination measures to maintain sterile operating environments, equipment, and facilities, thereby driving the demand for related services and technologies aimed at preventing surgical-site infections and safeguarding patient well-being. Furthermore, the robust growth of the healthcare, pharmaceutical, and biotechnology industries has significantly propelled the market, as these sectors require meticulous decontamination protocols to maintain sterile and contamination-free environments across their research and development as well as manufacturing processes.

Get a preview of the latest developments in the Bio Decontamination Market; Download your FREE sample PDF copy today and explore key data and trends

Hydrogen-peroxide-based decontamination equipment is becoming increasingly commonplace within these industries. As an illustration, in May 2022, Bionova Capital announced a further investment of EUR 750,000 in Delox, a company within its portfolio, bringing Delox's total capital raised to over EUR 1.3 million. This investment, backed by Bionova Capital, Caixa Capital, Kiilto Ventures, and a Portuguese family office, is intended to facilitate the launch of Delox's patented antimicrobial system. Delox's unique bio decontamination system boasts the capability to eliminate 99.9999% of all microbial entities, including bacteria and viruses, from laboratory equipment and work areas.

Governments and regulatory bodies worldwide are increasingly enforcing more stringent regulations and guidelines pertaining to bio decontamination procedures, particularly within healthcare, pharmaceutical manufacturing, and food processing sectors. Adherence to these regulations has compelled organizations to adopt advanced decontamination methods and technologies to guarantee the safety and sterility of their facilities and products. For instance, the U.S. Environmental Protection Agency (EPA) regulates disinfectants and sterilants under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Additionally, the U.S. Food and Drug Administration (FDA) provides specific guidelines for validating and monitoring sterilization processes for medical devices.

Detailed Segmentation

Component Insights

The equipment segment dominated the market and accounted for a share of 53.71% in 2023. The market is significantly driven by the advancement of innovative equipment, offering versatile and efficient solutions across various applications. For instance, in April 2021, Amira Srl launched the Bioreset Max, a compact and lightweight vapor generator that automatically adjusts hydrogen peroxide levels for optimum efficacy. This launch enhanced Amira Srl’s portfolio in cutting-edge bio decontamination technologies. Such high-tech equipment is essential despite the increasing focus on infection control, sterile production, and biosafety. Consequently, the equipment segment is expected to remain central in the market, responding to the pressing need for more effective decontamination solutions.

Agent Insights

On the basis of agent, the hydrogen peroxide segment held the largest share of 43.05% in 2023 and is anticipated to grow rapidly over the forecast period. Hydrogen peroxide is widely recognized for its antimicrobial properties, making it essential for decontaminating biological contaminants. Its use in healthcare settings, especially hospitals, is critical for preventing the spread of infections, such as ventilator-associated pneumonia & Clostridium difficile. Recent advancements have led to the development of innovative delivery methods, including vaporized and gas plasma technologies, significantly boosting its effectiveness. For instance, in September 2021, STERIS launched new vaporized hydrogen peroxide bio decontamination systems, the VHP 100i and 1000i. These are designed for the pharmaceutical and medical device sectors, aiming for a 6-log reduction in bioburden with user-friendly features.

Type Insights

On the basis of type, the chamber decontamination segment held the largest share of 58.28% in 2023. Chamber decontamination systems have become preferred over manual cleaning and disinfection, especially in highly regulated industries where strict standards must be met. Industries such as pharmaceutical and biotechnology rely on these systems to ensure the sterility of critical equipment, materials, and production environments. As the focus on infection control, product quality, and worker safety grows, chamber decontamination systems are expected to remain a key component in the overall market.

End-use Insights

The biotech companies & research organizations segment held the largest share of 42.21% in 2023 and is growing at the fastest CAGR over the forecast. Biotechnology and life sciences companies engaged in the research, development, and manufacture of pharmaceuticals, vaccines, & other biological products require stringent bio decontamination protocols to prevent cross-contamination and ensure the integrity of their products. Similarly, academic and government research institutions handling recombinant DNA, cell cultures, and other biohazardous materials have implemented comprehensive bio decontamination programs to safeguard their personnel & research. The growing emphasis on biosafety and biosecurity in these settings has been a key driver for adopting robust decontamination solutions.

Regional Insights

The North America bio decontamination market accounted for 44.08% share in 2023. The robust growth of the pharmaceutical and biotechnology industries in North America, particularly in the U.S. & Canada, has fueled the demand for bio decontamination technologies. For instance, in April 2022, CURIS System, a prominent player in the bio decontamination industry, obtained approval from Health Canada to introduce and distribute its products in the Canadian market. This regulatory approval signifies a significant milestone for CURIS System, allowing it to expand its reach and offer its innovative bio decontamination solutions to customers in Canada.

Key Bio Decontamination Company Insights

Some of the key players operating in the market are STERIS, Ecolab, and TOMI Environmental Solutions, Inc. These companies invest in product development, geographic expansion, and strategic partnerships to capitalize on the growing demand for bio decontamination solutions across various industries, particularly healthcare, pharmaceuticals, & biotechnology.

Key Bio Decontamination Companies:

The following are the leading companies in the bio decontamination market. These companies collectively hold the largest market share and dictate industry trends.

- Amira Srl

- ClorDiSys Solutions, Inc.

- Ecolab

- Fedegari Autoclavi S.p.A.

- Howorth Air Technology Limited

- JCE Biotechnology

- Noxilizer, Inc.

- STERIS

- TOMI Environmental Solutions, Inc.

- Zhejiang TAILIN Bioengineering Co., Ltd.

Curious about the Bio Decontamination Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In February 2024, CURIS System and AST announced a groundbreaking partnership in the pharmaceutical manufacturing industry. This collaboration aims to revolutionize the bio decontamination of aseptic fill-finish isolators by combining CURIS’s vapor decontamination technology with AST’s expertise in aseptic fill-finish processing.

- In October 2022, ChargePoint Technology Group, a powder & liquid transfer solutions specialist, partnered with STERIS, a leading provider of infection prevention products and services, to deliver a successful sterile solution to the specialty chemicals company Evonik. This partnership aimed to provide Evonik with advanced technology and expertise to ensure the sterility of its processes and products.