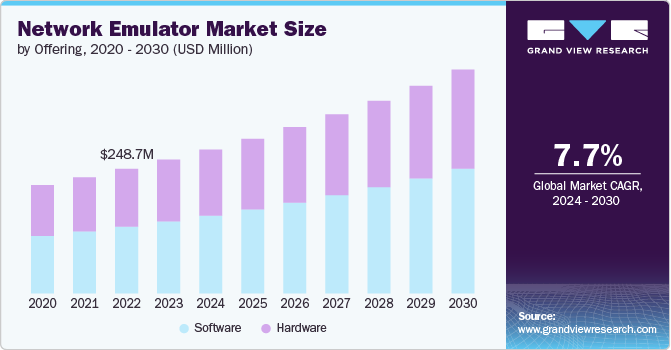

Imagine a digital sandbox where the unpredictable nature of networks – the internet's wild frontier – can be tamed and tested. This is the realm of the global network emulator market, a space estimated at USD 267.0 million in 2023 and now humming with a projected annual growth of 7.7% until 2030. What's fueling this digital expansion? Think of it as the rapid ascent into the clouds – the mass migration of vital applications and services to these ethereal digital realms.

As organizations entrust their critical workloads to the cloud's embrace, a crucial question arises: how will they perform amidst the ever-shifting winds of network conditions? Network emulators step into this arena as masterful simulators, recreating the real-world quirks of bandwidth bottlenecks and latency lags. This allows organizations to proactively identify and resolve potential performance hiccups before their applications take flight in the cloud, ensuring a smooth and seamless transition – a key driver propelling the demand for these predictive tools.

Furthermore, the digital landscape is becoming increasingly populated by a buzzing ecosystem of Internet of Things (IoT) devices, and the super-fast lanes of 5G networks are rolling out. Consider the IoT's pervasive integration into healthcare, manufacturing, and the very fabric of our smart cities. The need to rigorously test and validate the performance of these interconnected devices under a myriad of network conditions becomes paramount. Network emulators provide this crucial insight, allowing organizations to fine-tune their IoT solutions for reliable connectivity in the real world. Similarly, the advent of 5G, with its demands for ultra-low latency and immense bandwidth, necessitates meticulous testing. Network emulators act as the tuning forks, ensuring applications and services can harmonize with the unique frequencies of 5G.

Get a preview of the latest developments in the Network Emulator Market; Download your FREE sample PDF copy today and explore key data and trends

Another significant catalyst is the burgeoning era of remote work and virtual collaboration. With hybrid work models becoming the norm, organizations are heavily investing in technologies that guarantee robust and dependable network performance. Network emulators are the unsung heroes here, rigorously testing and optimizing Virtual Private Networks (VPNs) and other remote access technologies. This ensures businesses can maintain peak productivity and seamless communication across geographically dispersed teams. As remote work solidifies its place in the corporate world, the demand for sophisticated network emulation solutions is poised for substantial growth.

However, this promising trajectory isn't without its hurdles. The initial investment and the complexities of weaving these solutions into existing IT infrastructures can be significant. Smaller enterprises, in particular, might find the resources required for comprehensive network testing a stretch. Yet, this challenge has a potential silver lining: the rise of scalable, cloud-based network emulation solutions. Offering flexible pricing models and simpler integration, these cloud-native emulators can lower the barriers to entry, allowing vendors to broaden their reach and sustain the long-term growth of this vital market.

Detailed Segmentation

Offering Insights

The software segment led the market and accounted for 53.9% of the global revenue in 2023 and is expected to retain its dominance over the forecast period. Software-based network emulators are computer programs or applications meticulously designed to replicate real-world network conditions and behaviors within a controlled virtual environment. Their primary function is to allow users to imitate a range of network parameters, including bandwidth limitations, latency, and packet loss. Software-based network emulators serve as indispensable tools for validation, quality assurance, and development processes, enabling the early identification of issues and the optimization of performance.

Technology Insights

The IoT segment accounted for the largest market revenue share in 2023. The segment’s growth is driven by the escalating integration of IoT devices across various industries, such as healthcare, manufacturing, and smart cities. The increasing need to test and validate the performance of IoT solutions under diverse network conditions propels the demand for network emulators. These emulators enable organizations to optimize IoT connectivity, ensuring reliability and robust performance, thereby contributing significantly to the segment’s growth.

Test Insights

The application testing segment accounted for a significant market revenue share in 2023. The segment's growth is driven by the increasing complexity of modern applications and the need to ensure their seamless performance under varied network conditions. Market consumers are adopting application testing to identify and address potential issues early in the development cycle, enhancing user experience and reducing post-deployment failures. This proactive approach to quality assurance is crucial for maintaining a competitive advantage in the fast-paced technology landscape.

Application Insights

The telecommunication segment accounted for a significant market revenue share in 2023. The constant technological advancements and innovations in the IT & telecommunications industry drive the demand for network emulators. These tools are essential for testing and validating complex network environments characterized by intricate devices, protocols, and services. The industry's introduction of new technologies such as 5G, IoT, and cloud-based solutions further amplifies the demand for emulators to assess performance and security. Moreover, the critical focus on network security, regulatory compliance, and cost savings in this sector solidifies the central role of network emulators in maintaining network integrity and driving their prominence in the market.

Regional Insights

The North American network emulator market dominated the global market in 2023. The North American region, encompassing technologically advanced countries with strong infrastructures, serves as a major driver for the demand for network emulator solutions. The region's market dominance is a direct result of its well-established industries, which are capable of making substantial investments in advanced IT infrastructures, creating fertile ground for the adoption of network emulators. Moreover, the region's technological advancements, including the deployment of 5G networks, encourage telecom providers to incorporate network emulators across various network layers.

Key Network Emulator Company Insights

Key players operating in the network emulator market include VIAVI Solutions Inc., Apposite Technologies, Calnex Solutions, Polaris Networks, InterWorking Labs, Inc., and others. The key market players are focusing on various strategic initiatives, including new product development, mergers & acquisitions, partnerships & collaborations, and agreements to gain a competitive advantage over their competitors.

Key Network Emulator Companies:

The following are the leading companies in the network emulator market. These companies collectively hold the largest market share and dictate industry trends.

- Keysight Technologies

- Spirent Communications

- VIAVI Solutions Inc.

- Apposite Technologies

- Calnex Solutions

- Polaris Networks

- PacketStorm Communications, Inc.

- Aukua Systems Inc.

- InterWorking Labs, Inc.

- GigaNet Systems

Network Emulator Market Segmentation

Grand View Research has segmented the network emulator market based on offering, technology, test, application, and region:

- Offering Outlook (Revenue, USD Million, 2018 - 2030)

- Hardware

- Software

- Technology Outlook (Revenue, USD Million, 2018 - 2030)

- SD-WAN

- IoT

- Cloud

- Others

- Test Outlook (Revenue, USD Million, 2018 - 2030)

- Performance Testing

- Application Testing

- Others

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Telecommunication

- BFSI

- Government & Defense

- Healthcare/Medical

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa (MEA)

- UAE

- Kingdom of Saudi Arabia (KSA)

- South Africa

Curious about the Network Emulator Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.