U.S. Imaging Services Industry Overview

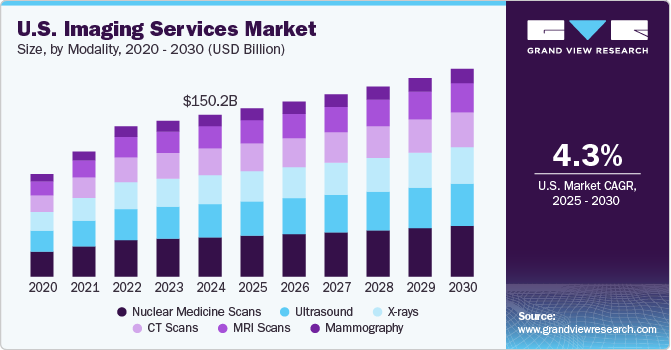

The U.S. Imaging Services Market, valued at USD 150.2 billion in 2024, is projected to grow at a CAGR of 4.3% from 2025 to 2030. This growth is primarily driven by the increasing incidence of cancer and cardiac disorders, along with growing awareness of medical imaging technology. For example, the International Agency for Research on Cancer reported approximately 2,380,189 new cancer cases in the U.S. in 2022, with projections reaching 7,845,698 within the next five years. Furthermore, advancements in medical imaging technologies are expected to fuel market growth during the forecast period.

Medical imaging is a preferred diagnostic method, offering crucial information rapidly, safely, and accurately through modalities like X-ray, ultrasound, nuclear medicine scans, MRI, and CT scans. These non-invasive techniques facilitate easy disease diagnosis and early detection, leading to better treatment outcomes. The development of enhanced imaging technologies is anticipated to further boost market growth in the coming years. Additionally, the rapidly growing aging population, high cancer rates, increasing research funding, and rising private-public initiatives in medical imaging are expected to propel overall market growth.

Detailed Segmentation:

- Modality Insights

The magnetic resonance imaging segment is expected to grow at the highest CAGR of 4.7% over the forecast period. Owing to factors such as the increasing geriatric population, technological advancements such as the introduction of hybrid MRI equipment, high-field MRI, superconducting (SC) magnets, and installation of software, availability of universal health coverage, and growing burden on chronic diseases are fueling market growth.

- End-use Insights

Diagnostic imaging centers are expected to witness segment growth in the market due to the increasing demand for outpatient imaging services. The shift toward value-based healthcare and cost-reducing measures has led healthcare providers to prefer outpatient settings, offering lower costs and greater patient convenience. In addition, advancements in imaging technology, such as AI-assisted diagnostics and portable imaging solutions, enable diagnostic centers to provide faster and more accurate results. Many imaging centers are also expanding their service offerings to include advanced modalities such as PET-CT and 3D mammography, attracting a larger patient base and increasing their market presence.

Gather more insights about the market drivers, restraints, and growth of the U.S. Imaging Services Market

Key Companies & Market Share Insights

The U.S. market is highly competitive and has several key players. The major market players are focused on forming partnerships to enhance imaging services and patient care, taking advantage of important cooperation activities, and exploring mergers & acquisitions. For instance, in March 2023, Medtronic and NVIDIA stated that they have partnered to accelerate the expansion of AI in the healthcare system and convey new AI-based solutions into patient care. Also, apart from Medtronic, the company is aiming for more such AI or metaverse-driven partnerships to advance medical imaging & medical devices, as per NVIDIA's GTC 2023 conference.

Key U.S. Imaging Services Companies:

- Radnet, Inc.

- Alliance Medical

- Inhealth Group

- Sonic Healthcare

- Dignity Health

- Medica Group

- Global Diagnostics

- Novant Health

- Concord Medical Services Holdings Limited

- Center for Diagnostic Imaging, Inc.

- Unilabs

- Healius Limited

- Simonmed Imaging

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2024, IKS Health partnered with Radiology Partners to enhance radiology services using its AI-powered Care Enablement Platform. This collaboration aims to streamline workflows, reduce administrative burdens, and improve imaging access, allowing over 3,900 radiologists to dedicate more time to patient care.

- In July 2024, Rayus Radiology partnered with AI startup Ezra to introduce whole-body MRI services in Seattle, aiming to detect early-stage cancers and over 500 other conditions across 13 organs. This collaboration addresses the growing demand for comprehensive disease monitoring.

- In April 2024, Ezra Health partnered with RAYUS Radiology to offer AI-enabled full-body MRI scans at 150 RAYUS locations across the U.S. Ezra's technology monitors for over 500 conditions in 13 organs, aiming to detect diseases early. Their Ezra Flash software, FDA-approved in 2023, enhances MRI efficiency and image quality.

- In February 2023, Radnet, Inc. introduced an enhanced breast cancer detection program in New Jersey and New York. This imaging service network will benefit patients with an enhanced screening mammography service for cancer detection.